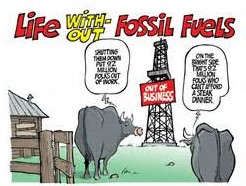

While President Obama supports the warming of global temperature scare being foisted upon us by environmentalists, the European financial sector has begun looking at the risks associated with the reduction of carbon dioxide emissions.

Finally, someone is looking at a different cause and effect. European financial regulators are examining how banks, insurers and pension funds would cope if policies designed to reduce carbon dioxide emissions led to a sharp drop in the share price of oil, gas and coal companies.

They view the aim to contain average temperature increases through drastic goals to cut emissions could cause selloffs of fossil-fuel companies and other economic problems caused by energy shortages brought about by a poorly-managed, and a hasty switch to solar and wind energy.

While the group of European regulators further examine the risks to companies with carbon-heavy assets, they note that banks, insurers and pension funds hold about $1.13 trillion in equity and debt of fossil fuel companies. They estimate that major stock indexes could fall as much as 20 percent if assets are revalued in line with the effort to cut temperature increases by 1.5 degrees.

Meanwhile, U.S. Secretary of State John Kerry says that climate change is our most serious threat; more so than ISIS, and Sen. Sheldon Whitehouse’s (D-RI) wants to punish those who are climate change deniers.

Hopefully, Wall Street is also looking into the financial risks of reducing carbon emissions to U.S. stockholders, and cooler heads will prevail.

KRAMER NOTE: Regular readers know my position on the hoax associated with climate change. Yes, a slight warming has been detected in recent years, but as long as climate changes have been recorded, we have seen warming and cooling. And, remarkably, we saw warming before the introduction of the combustion engine.

(If you would like to be a free subscriber to kramerontheright, simply scroll down to the bottom of the column at right.)